Hey everyone, a lot of craziness happening in the world these days and that is killing stocks.

Coronavirus is Out of Control

More and more cases of the virus are popping up all over the world and it’s likely that this will become a pandemic that will, at least in the short term, have a major impact on the global economy.

Stock Market on Sale

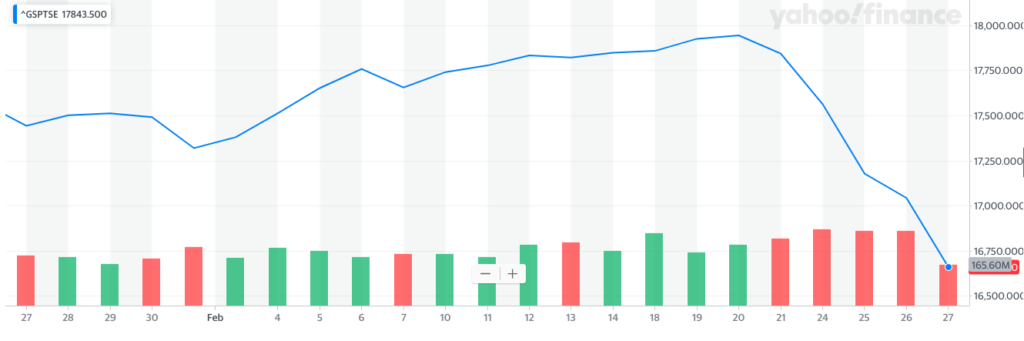

Coronavirus fears kneecapped the stock market rally, and we’re seeing major declines across the board. So far, the TSX has fallen 1300 points or over 7% from its peak of 17951 on Feb 20. The Dow and S&P 500 have also dropped considerably.

This really shouldn’t have come as a surprise because valuations were reaching nose bleed levels. In fact, last week I was lamenting these asset bubbles because I want to put some cash to work.

I have a lot of cash on the sidelines that I want to invest and I know timing the market can be a fools game. That said, the greatest investor ever, Mr. Warren Buffett, has well over $100 billion in cash on the sidelines and it seems like all the big pension funds were selling stocks and buying infrastructure and other less risky assets.

Those moves should tell us small time investors something. The Big players are preparing for leaner times.

We haven’t seen a decline like this since December 2018 and I’m excited to buy some quality stocks on sale.

These sell-offs provide long term investors with great buying opportunities. As with all types of investing whether it be stocks or real estate or anything else, you make you money when you buy quality assets at a great price; not when you follow the herd and buy into a bubble.

Stocks I’m Watching

I’m looking at a basket of Canadian stocks. Banks are coming down after the bunch reported mediocre earnings.

I was surprised that Scotiabank (BNS) didn’t raise its dividend this quarter. The bank usually raises twice a year in August and February. When a bank doesn’t raise its dividend that should also tell investors something.

This earnings season BNS was the odd man out as the other banks upped their dividends, but not by as much as they used to. TD, today raised 7% when they usually do 9-10%.

Overall there’s enough signals out there to indicate that consumers are tapped out, businesses are growing more cautious and the economy is stalling.

Here are the stocks I’m watching and hoping to buy:

Any of the Big 5 Canadian Banks, if they fall another 5%.

For energy, Suncor has been hammered as oil declines, so it’s looking attractive.

Manulife is yielding nearly 5% so it’s on my radar.

Telus is dropping quite a bit too. If it gets to the mid 40s then I might buy in.

I see that Enbridge (ENB)has falling back below $50 so if it gets to the mid 40s that too would be a decent buy.

Again these are some of the stocks I own for the long term. They may very well decline further, but I’m thinking long term.

Investing in Bear Markets Makes People Rich

If we get another major correction of 30% or more that would be great for my long term plans.

I started investing just before the big crash of 2008-09 and I’ve massively benefited from the 11 year Bull Market. So I’ll be the first to admit that great timing certainly had a role in my financial success.

The same can be said for my first real estate purchase.

I think getting into things at the right time plays an important role in our successes. For the last 10 years we investors had a nice tailwind with cheap easy money fueling massive asset bubbles.

Once all the euphoria gets flushed out of the system then I think there will be a great opportunity to achieve true financial freedom in the next Bull Market.

Torex Coin Auction Result

Well, sadly I was outbid on my coin. It’s hard to get old Victorian silver at decent prices nowadays. These auctions are a great way to buy high grade investment coins, but you still have to get a decent price to make it a good investment.

At an auction like Torex you need to keep your emotions in check, otherwise you might end up massively overpaying for your coin.

Cheers! And have a great week everyone!

In case you’re wondering here’s where I park my money and some financial services that I use:

For my Daily banking and no-fee cash back credit card I use Tangerine. Curious? Check out my Tangerine vs Simplii Financial review and the Tangerine Money Back Credit Card Review.

For my Savings I use the EQ Bank Savings Plus Account. Never heard of it? Click the link to check out my EQ Bank Savings Plus Account Review.

For investing I use a combination of TD Waterhouse (for legacy investments) and Questrade (low cost stock purchases and free ETF purchases). If you haven’t done so already, check out my Questrade Review to see why it’s the best deal around. Get $50 in Free Trades when you signup for Questrade through this link.