Here’s a list of the top 10 Alternative Investments.

With stocks at record highs, bond yields at record lows and interest on savings accounts at pitiful levels, where do we invest nowadays?

More and more investors are looking beyond traditional investments like the ones above and are moving into the world of alternative investments.

Most alternative investments are “real” and tangible, which makes them appealing to those wary of the unlimited money printing by central banks around the world.

What Are Alternative Investments

Alternative Investments are simply investments that fall outside the norm of stocks (equities), bonds (income), and cash. They can include things such as private equity, commodities, real estate and collectibles.

Alternative investments may have little correlation to more traditional investments, but that’s only because they tend to be held for long periods of time and are not bought and sold all day long.

They also lack liquidity. So if you invest in this area be prepared to hold for a long time.

On the other hand owning some alternative investments can be pretty cool, especially if you own some rare or unique art, coins or antiques.

The key to alternative investments is knowledge. In fact, lots of people turn their passion or hobby into a form of alternative investing.

So here are the Top 10 Alternative Investments in no particular order.

Top 10 Alternative Investments:

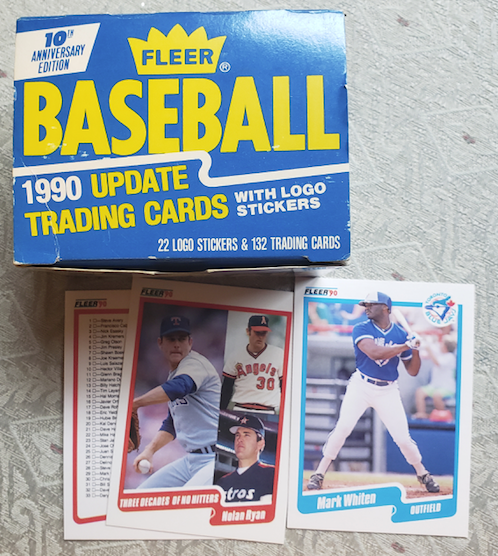

Sports Cards

The health crisis and stock market collapse sent a lot of money into the sports card market in 2020. Check out this article on ESPN about the sports card boom.

Old sports cards from the 1970s and earlier, were highly sought after in the 1980s and early 1990s. The sports card industry decided to cash in on the craze and massively overproduced cards in the 1990s. This did not end well and crashed card values from that era.

Today, the card industry focuses more on rarity and limited editions to boost collector confidence and card values.

Rare Coins

Coin collecting can be an interesting alternative investment strategy. Genuine rare coins will always appreciate in value. For example, the famous John Jay Pittman collection sold for over $30 million in the 1990s.

I’ve been collecting coins since I was a kid and have seen the collection consistently appreciate over time. My tips are to focus on rarity and quality…in that order.

A rare coin in horrible condition will always be more sought after than a common coin in excellent condition. Buy rarity and hold it for a long time and you’ll see some decent returns.

Commodities

Commodities are another alternative investment. There are different ways for investors to gain exposure to commodities.

One ways is direct ownership, where someone buys and stores a given commodity. such as grain, wheat, corn or even oil.

Another way is to trade futures contracts. This requires some specialized knowledge or else a person could lose a lot of money.

Some other ways would be to invest in exchange traded funds (ETFs) that track a given commodity such as oil or natural gas; or invest in stocks that produce oil, gas, potash, gold, silver, copper, rare earth metals etc.

Online Business

The digital age offers one of the easiest ways to get into one of the fastest growing alternative investments: an online business.

Start-up costs are about $200, plus some time and effort. I created this website through Bluehost. If you want to get started check out my How to Start a Blog Post.

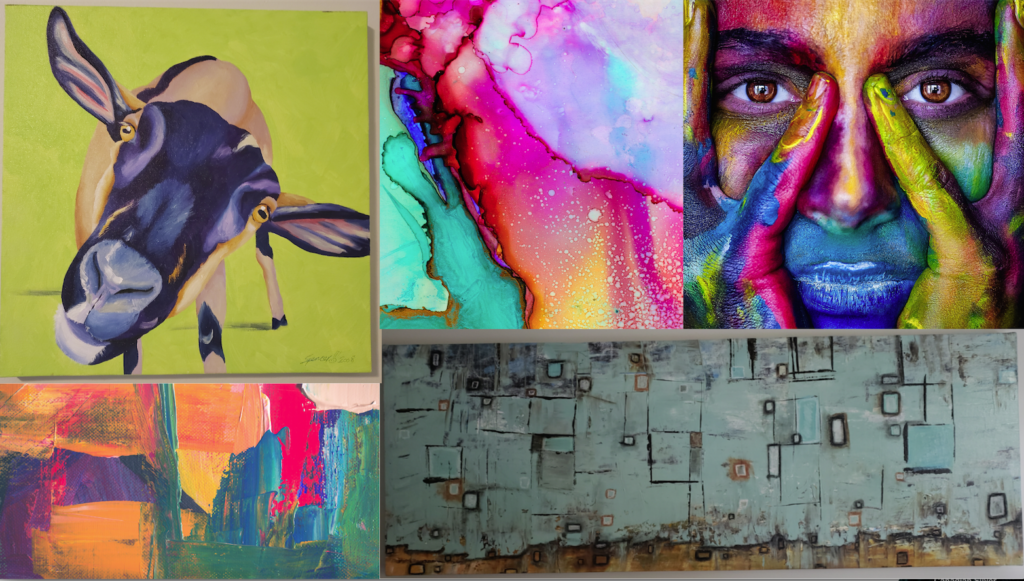

Art Investing

Fine art has always been an alternative investment class. But before jumping into this type of investment, you need to do your homework. Research the artist, the market, auction houses and galleries.

Also keep an eye out for estate sales and even second hand shops. There’s been a lot of major art finds in places like yard sales and estate sales. Remember, most art purchased is never sold. So you may hit the jackpot by looking where no one else is.

Private Equity

Private Equity investments are not publicly listed entities available on stock exchanges. Instead, private equity is capital held by investors or funds that invests directly in private businesses.

Generally speaking, private equity investments should be for long term investors who don’t need access to their money for a long time. Private equity investments can be difficult to value because they don’t trade on the open market.

Also, these investments can be illiquid, unless you find someone to buy you out of your position.

Cryptocurrency

Crypto currencies such as Bitcoin, Ethereum and Ripple have emerged over the last decade as an alternative investment class.

A cryptocurrency (or crypto currency) is a digital asset designed to work as a medium of exchange wherein individual coin ownership records are stored in a ledger existing in a form of computerized database using strong cryptography to secure transaction records, to control the creation of additional coins, and to verify the transfer of coin ownership.

[A cryptocurrency] typically does not exist in physical form (like paper money) and is typically not issued by a central authority. Cryptocurrencies typically use decentralized control as opposed to centralized digital currency and central banking systems.

The advantage and appeal of crypto is that it is decentralized and exists out of the mainstream international monetary system.

Real Estate and Land

Real estate has always been a great alternative investment. Whether you’re investing in farmland, rental properties or speculating on future developments, real estate has made more millionaires than any other asset class.

The one major consideration with this type of alternative investment is that it has a high barrier of entry relative to the other types of alternative investments on this list. There are also tax implication for owning any kind of real estate whether it’s an apartment building, or vacant land.

Antiques and Jewelry

Antiques are also an alternative investment class. They are tangible assets with very limited supply due to their age. Many prized pieces are rare because over time, they get lost or destroyed.

Once again, it’s important to educate yourself before speculating in the antique market. Antique jewelry has always been highly collectable. Some people collect antique high end watches for example.

Precious Metals

Precious metals have always been considered an alternative investment class because they exist outside the mainstream financial system.

Gold and silver are the most widely recognized precious metals, but there are others such as palladium, platinum and rhodium. Check out Kitco for up to the minute quotes on these metals.

Precious metals have intrinsic value as well as industrial value. For centuries, gold and silver have been seen as money and have been a store of value. My readers know that I buy my precious metals from Silver Gold Bull because they price match and offer fast, insured, delivery.

Precious metals are also important industrial commodities. These metals are used to manufacture products such as solar panels and smart phones (silver) and catalytic converters for vehicle exhaust systems (palladium, platinum and rhodium).

Thanks for reading this post on Top 10 Alternative Investments.

Please note this post contains affiliate links from Silver Gold Bull and Bluehost where this website may receive a small commission on purchases.