In this post I look at how anyone…that’s right I said ANYONE…can become a TFSA millionaire. If you don’t know anything about investing then this post is for you. This is the time of year when everyone’s focus and attention are on their RRSP contributions so they can get a big, fat tax refund. The TFSA, on the other hand, is often overlooked as a long term investment strategy.

In this post I look at how anyone…that’s right I said ANYONE…can become a TFSA millionaire. If you don’t know anything about investing then this post is for you. This is the time of year when everyone’s focus and attention are on their RRSP contributions so they can get a big, fat tax refund. The TFSA, on the other hand, is often overlooked as a long term investment strategy.

Please note: this page contains affiliate links. As an affiliate of Questrade, this blog receives a commission for each sign up.

It’s no secret that the vast majority of Canadians are not using their TFSAs to their full potential. They choose to stick their money in low interest savings accounts rather than investing the money for a greater return. TFSA money is used for things like cars, vacations, maybe even a down payment on a home. It is used for anything and everything except for the one thing that would do nearly everyone the most good: using it as a long term savings vehicle that will make them tax-free millionaires.

What is a TFSA?

A TFSA is a tax-free savings account. It was first introduced back in 2009 and has become a popular savings vehicle because it allows contributions and withdrawals on a tax-free basis.

Some Features of the TFSA

- Unlike an RRSP, you cannot claim a deduction for TFSA contributions.

- The current annual contribution limit is $5,500.

- If you were 18 years of age or older in 2009 and have never made any TFSA contributions, you have accumulated $36,500 in contribution room.

- Special rules govern withdrawals and contributions so it’s important to track your TFSA activities.

For more information about the TFSA read my post here.

How to Become A TFSA Millionaire

Step 1

Open a Questrade discount brokerage account. You’ll need to fill out some online forms but what little time and effort this costs you will be well worth it in the long run. If you need help, refer to my review and step by step guide on How to Open A Questrade Account. I really like Questrade because they offer commission-free exchange-traded fund (ETF) purchases. This saves you some upfront costs which means you get put more of money to work immediately.

Step 2

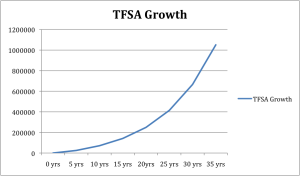

Buy the iShares Balanced Income CorePortfolio Index ETF (CBD). It is a reasonable low-cost ETF with an MER around 0.75%. Most ETFs offer monthly purchase plans where you can purchase shares for as little as $25. The CBD monthly purchase plan will be very useful because you’ll need to contribute $458.33 every month into (CBD) and reinvest the monthly dividend/interest income. If you can do this and keep it up for 35 years, you will become a millionaire thanks to good old fashioned saving and the power of compounding.

What is a Balanced ETF?

An ETF is something that trades like a stock on an exchange. A balanced ETF offers investors the opportunity to invest in a mix of stocks and bonds. The fund is typically a 60/40 stock/bond split. The average rate of return for a balanced fund ranges from 5% to 7%. My calculations assume a 6% rate of return.

Why a Balanced ETF?

A balanced index ETF can be a great investment option for anyone who has little to no investing knowledge and who is concerned about the safety of their principal. While there are always risks associated with investing, balanced funds and ETFs don’t suffer as much during market declines so they can be a steady long term investment option for those who are reluctant to take bigger investment risks. For more information about balanced funds read my article here.

Thanks for reading my post on how to become a TFSA millionaire.

For more tips and tricks on how to build wealth check out my How To Become A Millionaire

Photo Credit: Photo by Stuart Miles / FreeDigitalPhotos.net

Sign me up! $458.33 every month is very affordable and that will still make us a millionaire… Amazing. My goal is slightly higher than $458.33 per month but at least $2000 per month. I think it has been going alright so far for me but I will have to work harder to increase the saving rate.

Thanks for the great strategy.

BeSmartRich

I like it! 2k a month is ambitious but certainly possible with the right savings approach. The more you save upfront the sooner you reach financial freedom!

I disagree with picking ETFs in your TFSA. Who wants to give that MER in the ETF over 20 years? It’s not guaranteed and they keep taking that MER. Granted, its lower than mutual funds but still, your going backwards instead of forward.

I would max out my $5,500 every year into BCE or even a big 5 bank stock. No MERs ever. I hate fees.

Hi Peter, thanks for your comment. I hear what you’re saying about fees. Personally, I tend to own bank stock in my TFSA but for most people, owning a single stock is simply too risky and they have difficulty stomaching the ups and downs of the market. So that’s why I’d recommend owning index funds or ETFs to the average person. The fees are pretty small (less than 0.5%) and they get the benefit of broad diversification so they can sleep at night. For anyone interested, I also wrote a piece on the Danger of Mutual Fund Fees.