Here’s my review of the Tangerine Money Back Credit Card. I’m a big fan of no-fee cash rewards credit cards because it saves me money and I use the cash rewards I get to boost my investing funds.

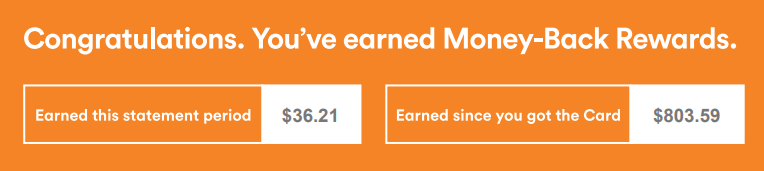

I’ve used cards from Walmart, PC Financial and MBNA and I have to say that the Tangerine Credit Card is the best fit for me. I’ve been using this card for nearly 2 years and have earned hundreds of dollars in cash back rewards. In fact check out the image below for proof:

That’s right, I earned over $800 for making my usual purchases on my Tangerine Money Back Credit Card. Keep reading to find out why this is my absolute favourite cash rewards credit card.

Please note this post contains affiliate links. As an affiliate of Tangerine, this blog receives a small commission from every sign up.

Tangerine Money Back Credit Card Highlights

Here are some of the card’s major benefits, and why I think it offers people lots of value.

No Annual Fee

Unlike other cash reward credit cards, you won’t have to pay an up-front annual fee for using the card!

2% Cash Back on Select Purchases

That’s right! Get 2% cash back on selected purchase categories and 0.50% on everything else. These select categories include things like groceries, restaurants, clothing, furniture and home décor, gas, automated bills, etc. During the enrolment process for the card, you can choose 2 categories to get the 2% cash back. If you choose to have your cash rewards deposited into your Tangerine Savings Account, then you get to choose an additional 3rd category to get the 2% off bonus.

These 2% cash back categories are great. I use mine for groceries, automated bill (ie. My cell phone bill, insurance etc), and gas for my car.

Cash Rewards are Paid Out Monthly

That’s right. Every month you can expect to get whatever cash rewards you earned up to that point. Which brings me to my favourite part about the Tangerine Money Back Credit Card…

No Payout Thresholds for Your Cash Rewards

What I like most about the credit card cash rewards is that each and every month I get the FULL value of my cash rewards earned up to that point deposited into my Tangerine Savings Account. Unlike other cash rewards cards like the Walmart credit card or others where you need to hit a certain threshold before getting paid, the Tangerine Money Back Credit Card pays out all of the rewards earned the previous month regardless of how much (or how little) they are. Nothing pisses me off more than having rewards stranded forever (ie. MBNA). So I’m happy that Tangerine doesn’t stinge out on the cash back rewards like MBNA did.

No Set Limit on Cash Rewards

What’s even better is that there is absolutely no limit on the amount of cash rewards you can earn. Some cash back credit cards have limits like $400 annually. Not so with the Tangerine Money Back Credit Card. Now I’m not advocating the excessive use of a credit card to earn cash rewards but if you’re someone who uses your credit card a lot, then you might wanna give this card a try.

One final thing about this card is that you don’t necessarily have to bank with Tangerine to use it. Although there are many benefits to using it with a Tangerine Savings Account. I would recommend at least opening a savings account to receive the full benefits of the cash rewards. Besides, it’s all no-fee banking so what have you got to lose?

Sign Up for the Tangerine Money Back Credit Card

If this is the card for you simply

Click Here to Sign Up For the Tangerine Money Back Credit Card

Or click on the Tangerine Credit Card Image Below and click on the Apply Now Button on the Tangerine Website.

The Tangerine Money Back Credit Card is a really great cash back credit card that will put cold hard cash in your bank account every month no matter how much or how little you earn. Thanks for reading this review of the Tangerine Money Back Credit Card.

For more about the benefits of Tangerine Bank see my post on No-Fee Banking