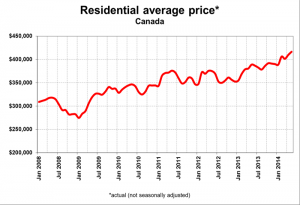

Since the Global Financial Crisis of 2008-2009, record low interest rates have been fuelling rising asset prices. Real estate, stocks, bonds and commodities have hit, and are at, all-time highs as evidenced by the charts below:

Source: http://creastats.crea.ca/natl/index.htm

Here is the Canadian Real Estate Association’s (CREA) chart for average Canadian home prices since January 2008. Home prices for the month of May have hit an all-time high of $416,584.

Source: http://www.tradingeconomics.com/canada/stock-market

The Toronto Stock Exchange (TSX) is also hitting all-time highs. It closed yesterday (June 18) at 15,109 surpassing its previous all-time high of 15,073 six years ago to the day.

The S&P 500 is also at an all-time high, closing at 1957 on June 18.

Source: http://www.tradingeconomics.com/canada/government-bond-yield

10-Year Bond yields have recovered a bit from their all-time lows last year (May 2013), but prices remain high by historical standards.

With asset prices at record highs where does one invest their money these days? As investors, we seek to buy low and sell high which makes this a particularly challenging environment. I’m reminded of Warren Buffett’s famous quote: “Be fearful when others are greedy and greedy when others are fearful.” Is this the time to be fearful while greed carries the day? I’m not sure, but what I can say is that, as a long term investor, I’m sticking to my investment plan and my short-term financial goals.

My focus this year has been on trying to eliminate non-deductible mortgage debt. This will clean up my liabilities on my net worth statement, leaving only a HELOC that is used to invest in Canadian eligible dividend stocks and where the interest on that loan is tax deductible. Getting rid of that mortgage debt is an important milestone on the road to financial freedom. In fact, Moneysense’s Jonathan Chevreau has stated that “the foundation of financial independence is a paid-for home.” Having the mortgage paid off will dramatically increase my monthly cash-flow and I’ll be in a strong position to take advantage of any market correction. After all, CASH IS KING as they say.

Given where the markets are today, I’m reluctant to borrow any more money to invest at these levels. While the availability of cheap money does give investors the opportunity to borrow at record low interest rates, on the flip side, once rates start to rise, it can put them at risk of margin calls if their stocks drop in price. I think that borrowing beyond one’s means is particularly risky nowadays. In my view, although cheap money is tempting, it is important for people to know their limit and borrow within it.

What I have been doing lately is rebalancing my holdings in my RRSP. I’ve sold off some of my TD e-series funds (Canadian Index, US Index and International Index) to keep each of them at their target allocation of 20%. I continue to make automatic purchases of e-series funds in my RRSP and stocks in my DRIP accounts. I do so for a few reasons. First, it takes time to setup automatic purchases so I don’t want to go through the hassle of stopping and starting them. Second, my dollar cost averages (DCA) are well below the current values of these assets so I’m comfortable with my holdings. Finally, the amounts aren’t all that much so I’m not concerned about “buying high” and I always have the option of rebalancing my holdings.

Great post, thank you for sharing

I would say pay down some debts if you cannot find any under value stocks at this market high. I borrowed money to buy stocks 2 years ago, and the move paid off well. Now, I am trying pay down the debts, so, I can borrow more money to buy high quality stocks if stocks value go down.

Best regards,

Thanks. I couldn’t agree more with you. I’m all for using leverage when stock valuations become compelling but right now it is really difficult to find value in the markets.

I use TD e-series funds as well 🙂 I bank with TD so it’s easy for me to put money in or take money out of those funds. I know what you mean about the tempting low interest rates to borrow. Unlike you I do not have the will power to restrain myself lol. Instead of equities I’m looking at investments in the fixed income space right now to balance my portfolio. I want to bring up my fixed income exposure to 5% of my total portfolio by the end of the year.

If we get another rising interest rate scare like we did last May-June a lot of fixed income securities and blue chip dividend stocks will be on sale again! I got lucky back in December and picked up some XRE, CPD, VSC and VSB at decent prices. I’m hoping to get another opportunity like that this year.

A very timely and often asked question these days as almost every sector and stock seems to be at record levels with sky high PE’s as well. For me, I have been looking at the financial sector of all places for relative value with names as CB, AFL, WFC and USB. From the consumer space KRFT seems to interest me. While cash is king and everyone waits on the sidelines for the next buying opportunity time is lost from receiving compounding dividends. Thanks for sharing.

Thanks for stopping by DivHut. So true, you can’t time the market and there is the risk of lost time for compounded returns. That’s why I’m sticking to my investment plan by making my regular, automatic investments.