Hey everyone and welcome to another weekly recap post for September 13, 2020. Since March, the big question on investors’ minds has been will we get inflation or deflation going forward? Let’s talk about it.

But first, my disclaimer: this post contains affiliate links where the blog may receive a small commission on any sales from Silver Gold Bull, EQ Bank, Questrade and Tangerine.

Inflation versus Deflation

Are we headed for inflation or deflation?

After the massive deflationary events in March, governments and central banks around the world have been throwing the kitchen sink at markets with easy money, zero interest rates and government stimulus cheques.

The jury’s still out on whether or not this will work.

Recently, the Fed announced that it would abandon its goal of keeping inflation around 2% and allow it to run higher.

Usually I try to tune out all the BS noise from the talking heads on BNN and CNBC, but this past week we had some very important comments from people that I think are worth listening to.

Stanley Druckenmiller

First, Wall Street Legend Stanley Druckenmiller called out Fed chair Jerome Powell for creating the biggest stock market bubble in history and begging congress to pass more stimulus.

He said that if the stock market bubble bursts, it could trigger a massive deflationary event like we saw in March.

Druckenmiller also said that he’s worried about inflation in the 5% to 10% range going forward.

Alan Greenspan

Druckenmiller’s concern echoed former Fed chairman Alan Greenspan who said in a recent interview that he’s worried about inflation too.

His concern about inflation had to do with the $100 trillion of benefits and entitlements (ie. Medicare/caid and Social Security) owed to the American people. Where will all of this money come from? They’ll print it; which further increases the money supply and by extension inflation.

Greenspan’s concern is noteworthy because he’s the one who started us all down the path we’re on, where the Fed just keeps inflating asset bubble after asset bubble. After each bubble bursts, it takes more and more bailout money to keep things afloat.

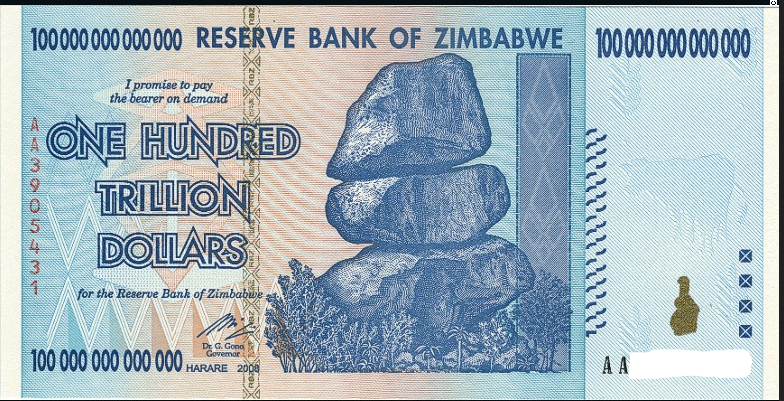

History is full of examples of what happens when a country starts dramatically increases the money supply by printing more and more of its currency. You get inflation (ie. more dollars chasing fewer goods). In extreme cases (ie. Weimar Germany, Zimbabwe) you get hyper inflation.

As the world’s reserve currency, the US dollar holds a special place in international finance and trade. So for the first time since the end of World War 2, we may be on cusp of a major change in the global monetary system.

Good Investments for an Inflationary World

Most of us have never experienced an inflationary world. The last time we saw the kind of inflation that we could be headed for was in the 1970s. Back then, Gen X ers were too young and Millennials weren’t born yet.

So which investments performed well back then?

Real assets performed quite well. Things like commodities (oil, base metals etc), gold and silver.

Financial assets on the other hand were in a 15 year bear market from 1968 to 1982.

This is why I think people need to rethink what diversification means and whether the traditional 60/40 stock/bond portfolio is a safe way to go.

Since March, I’ve added to my physical gold and silver holdings and will continue to buy some more on the dips. I use Silver Gold Bull for their fast and secure delivery and because they price match.

I’ve also started to build a position in oil stocks. So far, this hasn’t been working in my favor as these stocks dropped about 10%, but I’m thinking long term and will continue to add to these positions, especially if we get another market meltdown.

The next thing I’ve done is raise some cash. The markets have had a very good run off the March lows and tech has had an incredible run.

This cash will come in handy when we get another big sell off. If you haven’t done so already, sign up for a Questrade account with my link and you’ll get $50 in free stock trades and they offer free ETF purchases.

Growing Risks and Global Financial Strain

I think things could really unwind going into next year. The banks telegraphed that the economy is super weak, their core businesses were down 20% to 30%, we’re likely going to have a housing crisis as stimulus money runs out and delinquent homeowners face the music.

There’s also growing concern that we could be in for another banking crisis. Eurozone banks are weak, Chinese banks have a debt crisis on their hands and there is massive global debt in general.

Consumer’s are heavily indebted and never de-levered from 2008-09, and corporate debt levels are at an all-time record as a result of a decade of easy money for stock buy-backs.

Then there’s the possibility of a sovereign debt crisis. This is when countries default on their debt. In 2010-11 Greece was in trouble and there was a lot of concern that it could sink the nascent recovery from the Global Financial Crisis. An even bigger worry was Italy which would have taken down the whole system.

Look at how much bigger the problem is today. Now we could very well see Italy collapse as its economy took a huge hit this year. But there are far larger problems.

For example, the US has over $26 trillion of debt and over $100 trillion of benefits and entitlements (ie. Medicare/caid and Social Security).

Greenspan also mentioned that he was worried about he national debt and particularly that the government was underestimating the size of future deficits due to the payment of benefits and entitlements.

Canada is now approaching the $1 trillion mark in national debt. The Parliamentary Budget Office just said that we can run another $300 billion deficit, maybe a bit more before we pass the point of no return where there’s no way in hell we’ll be able to pay back the money.

Given all of the above, it feels like at some point we’ll get a financial system reset; which is why we’re seeing big institutional money (ie. pension plans, sovereign wealth funds, Warren Buffet, Ray Dalio etc.) run for gold.

Demographic Time Bomb

One more thing has been on my mind for a while now. Since 1982, the stock market has been on an incredible rise. There have been sell-offs and recessions along the way but for the most part it has been a great 40 years. Coincidentally, this remarkable period was characterized by the rise of mutual funds and index funds. It also coincides with the Baby Boomers peak earning years.

The boomers have been retiring in droves over the past 10 years, which means retirement portfolios and pensions need to pay out cash each month for living expenses.

As more and more boomers pull their money out, they will be selling off their stocks, bonds and mutual funds. Pension funds will also be drawing down their investments to meet their obligations.

So my question is this: will Millennials be able to offset that kind of selling? After all, Millennials (aka the Robinhood crowd) have had a rough go with 2 major recessions to deal with. Just some food for thought.

Save, Invest, Build Wealth and Prosper

In case you’re wondering here’s where I park my money and some financial services that I use:

For my precious metals I use Silver Gold Bull because they price match and offer fast, insured, delivery.

For my Daily banking I use Tangerine.

For my Savings I use the EQ Bank Savings Plus Account. Never heard of it? Click the link to check out my EQ Bank Savings Plus Account Review.

For investing I use a combination of TD Waterhouse (for legacy investments) and Questrade (low cost stock purchases and free ETF purchases). If you haven’t done so already, check out my Questrade Review to see why it’s the best deal around. Get $50 in Free Trades when you signup for Questrade through this link.