For those who find the world of investing to be scary, confusing and overwhelming, balanced funds can provide a relatively stable and conservative investment choice. Investing your money can be as complicated or as simple as you want it to be.

If you’re the type of person who just wants to set and forget your investment plan and are happy with achieving an average rate of return of about 7.5% annually, then a balanced fund may be just the type of investment product for you.

Before moving on to a comparison of 3 low-cost balanced funds, it’s important to look at what a balanced fund actually is.

What is a Balanced Fund?

Investopedia defines a balanced fund as: “A fund that combines a stock component, a bond component and, sometimes, a money market component, in a single portfolio.”

Basically, balanced funds usually hold about 60% of their assets in equities (ie. stocks, mutual funds and exchange-traded funds) and 40% in fixed income (ie. bonds or money market instruments). These funds are re-balanced on a quarterly basis to keep with those allocations. So you get a mix of risky stuff (stocks) and safe stuff (bonds) and that is why these funds offer only a moderate level of risk for an investor. These are “sleep at night” investments. For example, during the 2008-2009 crash, most equity index funds were down between 40%-50% while the average balanced fund only lost about 14%-15% and bounced back within a year.

These funds are more stable than an equity index fund because of their large fixed income component. So for people who lack the interest or experience in investing, these funds offer some comfort in that they will largely avoid the market gyrations that cause many investors to lose their nerve for being heavily invested in the stock market.

3 Low-Cost Options for Balanced Funds

I’ve been researching some low-cost balanced fund products lately for a family member and thought I’d share my research with you. Of course the key word here is low-cost because many studies have shown that investment fees and management expense ratios (MERs) significantly reduce investor returns over time.

I looked at 3 balanced funds:

- Tangerine Balanced Portfolio (fund code: INI220)

- TD Balanced Index Fund – I (fund code: TDB965) and

- iShares Balanced Income CorePortfolio Index ETF (ticker symbol: CBD)

Here’s what I found:

Balanced Fund Comparison

Tangerine Balanced Portfolio

28-Aug 2014 price: $12.43,

Yield: 1.48%

MER: 1.07%

Distribution Frequency: Annually

5-yr Ave. Return: 8.26%

TD Balanced Fund

28-Aug price 2014: $14.15

Yield: 2.02%

MER: 0.89%

Distribution Frequency: Quarterly

5-yr Ave. Return: 7.52%

iShares Balanced Income

28-Aug 2014 price: $21.64

Yield: 2.86%

MER: 0.72%

Distribution Frequency: Monthly

5-yr Ave. Return: 8.22%

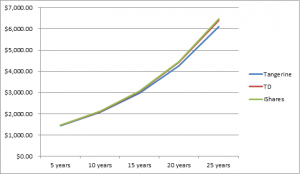

Looking at the chart above you can really see some big differences between the 3 funds. So we are clear, this is in fact an apples to apples comparison. So let’s discuss some of these differences.

Balanced Fund Asset Allocation

First off I’ll discuss the asset allocation of each fund as there are also big differences in this area. By far the fund with the most Canadian exposure is the TD Balanced Index Fund with 82% invested in that area. I think this overweighting of Canadian investment content is the reason why its 5-year annual return is nearly ¾ % lower than the other two.

The Tangerine Balanced Portfolio offers a bit more international diversification for its equity component of the fund. 40% of the fund is split between US and international equities.

By far the iShares Balanced Income CorePortfolio Index ETF offers the broadest diversification of all 3 balanced funds. The fixed income portion of the fund is split up amongst real return, government and corporate bond funds, while the equity component is split amongst Canadian and global dividend ETFs and Canadian and global real estate investment ETFs.

Balanced Fund Cost

Study after study shows how seemingly small fees add up to huge amounts of money over long periods of time and while all 3 of these funds are low-cost, there are clear differences in the MERs that I think make a difference. After all, we are talking about balanced funds which don’t offer huge returns but more average ones of between 5%-7% in a low growth world so every fraction of a percentage that you pay in fees should concern you.

The biggest difference between these funds has to do with the 0.35% difference between the Tangerine fund and the iShares fund. Over a 25 year period and based on an initial investment of $1000 compounding at annual rate of 7.5%, it will cost about $250 more in fees to own the Tangerine fund. This amount isn’t huge but if our principal was $10,000 then it would cost a little over $2,500 more for the Tangerine fund. Now we’re dealing with some serious cash.

Balanced Fund Distribution Frequency

It goes without saying that the more your money compounds, the quicker it will grow. With regard to distribution frequency, the iShares Balanced Income CorePortfolio Index ETF is the best because it pays out on a monthly basis which means that your money will grow faster than with the other 2 funds.

Over a 25 year period based on an initial investment of $1000, the difference between the iShares and Tangerine funds amounts to just under $400, while the difference between the TD and iShares fund is about $75. Again, these amounts aren’t huge but money is money, better in my pocket than in theirs.

Which Balanced Fund Makes the Cut?

The Tangerine Balanced Portfolio has the lowest yield (1.48%), the highest MER (1.07%) and the lowest distribution frequency (annually) of all 3 balanced funds. For these reasons, I think we should pass on this fund.

The major weakness of the TD Balanced Index Fund is that it is almost exclusively concentrated on Canada. This is not proper diversification which explains why it has lagged the other 2 funds that have more US and international investment content.

I think the best bang for your buck is the iShares Balanced Income CorePortfolio Index ETF (CBD). It offers the broadest diversification amongst and within asset classes, the lowest MER of all 3 funds, the highest yield and the highest distribution frequency (monthly).

It is an ETF though which means that it is traded on TSX like a stock, while the other 2 funds can be purchased through the investment services arm of the banks. But I don’t really see this as a major problem as nowadays discount brokers like Questrade offer commission-free ETF purchases. Even the discount brokers at CIBC and Scotiabank have moved in this direction. I really hope that TD Waterhouse will do the same one day. For a bank that always tries to be on the cutting edge of customer service they really are behind the curve where it counts the most!

Note: this page contains affiliate links. As an affiliate of Questrade and Tangerine, this blog receives a small commission for each sign up.

Photo Credit: Image courtesy of digitalart/FreeDigitalPhotos.net