Welcome to my Borrowell Review. A key skill for all financially minded people is the ability to properly use credit to our advantage and soundly manage our debt burdens. That’s why I think Borrowell offers an interesting way to do that.

What is Borrowell?

Borrowell is a Canadian online financial company that offers Canadians a completely Free Credit Score and monthly updated credit reports with the goal of saving us money.

Now some of you might be thinking is that a good idea to tap my credit score? First, viewing your credit score won’t affect it in any way at all. It is known as a “soft” check (versus a hard check when you actually apply for a loan or mortgage).

Why Does Borrowell Offer Canadians Free Credit Reports?

Borrowell offers free credit reports and the catch is that they may periodically send you loan, credit card or mortgage offers via email with interest rates that are tailored to your specific credit score. The company makes money through loan origination fees. All that means is that if you are looking for a loan and you find the best deal through Borrowell, then they will earn a finder’s fee. Their business model is broadly similar to that of mortgage-brokers.

Click Here to Get Your Free Credit Report

What Does Borrowell Offer?

Borrowell offers Canadians much more than just a free credit score. As you’ll see below, they offer low interest, fully amortized loans, mortgages and credit cards.

Get a Low Interest Loan with Borrowell

Borrowell offers Canadians up to $35,000 in unsecured, low-interest loans. The interest rate on the loan will depend on your credit score, but typically ranges from 5.60% to 29.19%. Their website states that “5.6% is the average rate for Borrowell customers who received the best grade on the Borrowell lending platform in 2017.” So, the better your credit score, the lower your interest rate.

This is quite different from the one size fits all approach that borrowers encounter at the big banks. At the banks, everyone basically pays the same interest rate no matter how good your credit score is. Borrowell uses our credit scores as the basis for offering us loans at the best possible interest rate…and if you’re in the market for a loan, that can save you a lot of money.

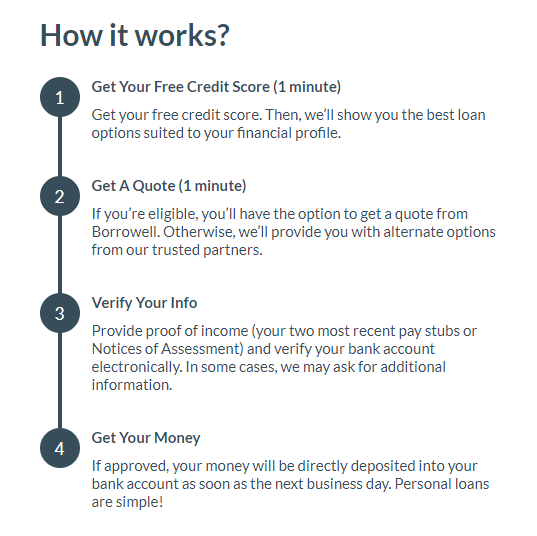

Borrowell has an easy 4 step loan application and its all done online! Check it out:

The great thing about this is that you can have the money deposited into your bank account in as little as 48 hours provided that you provided the necessary income verification and proof of identity that is required for the loan application.

Banks are becoming more and more picky with their loan applications and because life happens, not everyone has perfect credit. When you have bad credit, you’re only recourse for getting a loan is to use a credit card (at 20% to 30% interest) or worse a payday loan shop. These options only keep people on the debt treadmill. If you make minimum payments on your credit card, it could take over a decade to pay off $500.

This is where I think Borrowell fills a void between banks that won’t lend to anyone without stellar credit and the predatory practices of payday loan sharks. Borrowell can provide an unsecured loan at decent interest rate and it is fully amortized which means that there is a schedule of payments and, at a certain point, the loan will be paid off.

Why use a Borrowell loan? Maybe you want to consolidate your credit card debt or complete a home renovation. We all have our reasons for using debt. I’ve been using debt to finance my home renovations.

Click Here to Apply For Borrowell Loan

Get Mortgages and Credit Cards with Borrowell

Are you looking for a new credit card or do you want to do a balance transfer? Then Borrowell may have just what you are looking for. Borrowell also offers Mortgages if you happen to be house shopping.

Related: Click Here to See My Tangerine Money Back Credit Card Review

As consumers it’s important for us to shop around to try to get the best deal that we can. No one likes to get a loan or a mortgage only to find out that they could have had a better deal that would save them thousands of dollars. That’s why it’s so important to shop around and nowadays its never been easier. If you’re in the market for a loan check out what Borrowell has to offer. It could save you a lot of money in the long run.

Borrowell offers an impressive lineup of products that may be able to save some people a lot of money by reducing their borrowing costs. The average person saves about $4,800 in borrowing costs through Borrowell versus a high interest credit card. With interest rates on the rise, maybe now is the time to take a hard look at our debt load (mortgages, loans, car loan, lines of credit and credit cards) to see if we can shop around to get the best possible deal. It all starts with 1 simple step: Finding out Your Credit Score.

So Click Here to Get Your Free Credit Score

Thanks for reading my Borrowell Review. Please note that this post contains affiliate links. As an affiliate of Borrowell this blog receives a small commission for every signup.