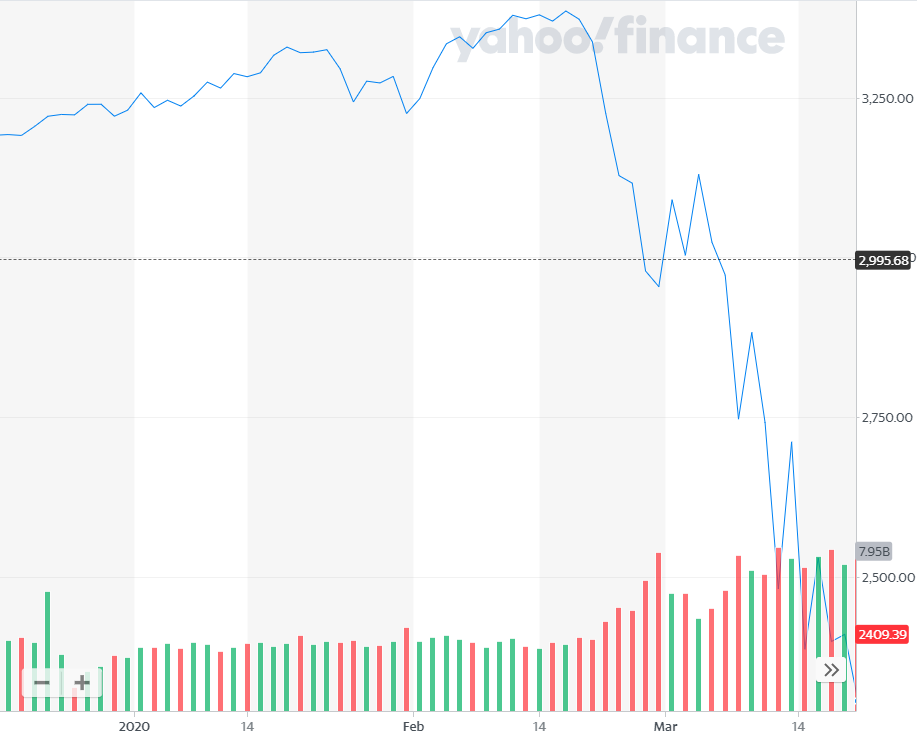

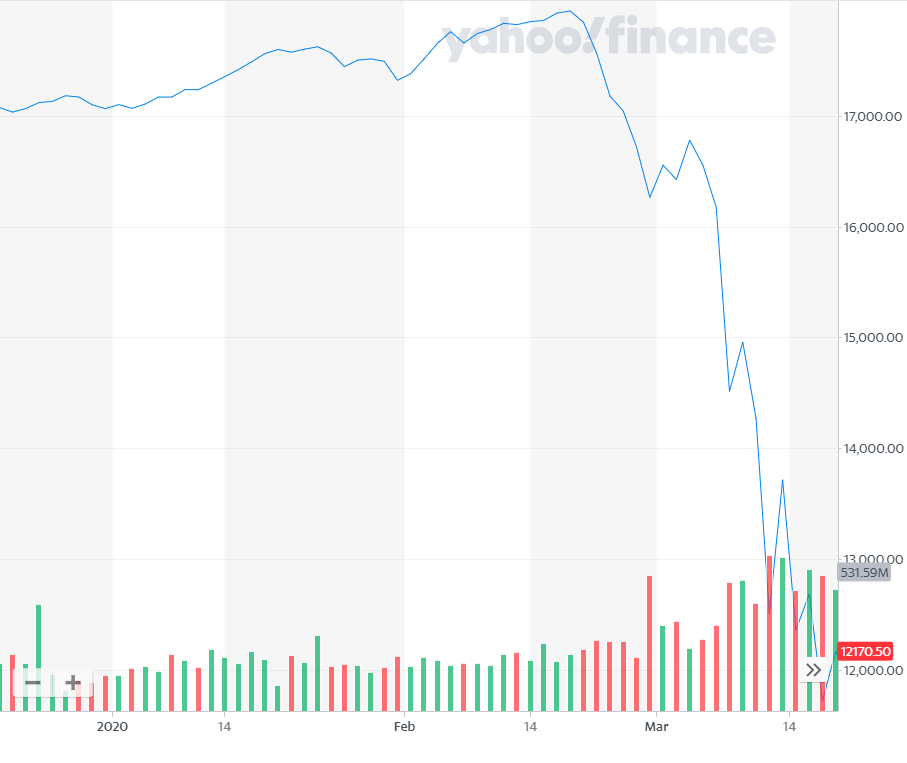

Hey everyone and welcome to this recap edition for March 21, 2020. That S&P 500 Chart is just nasty! The TSX is worse!

My last post on the Coronavirus was pretty depressing, I’ll admit, but I’m just so disgusted with the total lack of leadership on this issue.

Trump’s handling of this crisis is just downright disgusting and disgraceful. Too bad he’ll likely get through this without so much as a sniffle! Anyway, let’s move on to the markets and money.

Welcome to the Bear Market!

Well it’s been another crazy week on the stock market.

This has been the fastest (and scariest) stock market crash in history. We are now firmly in a Bear Market and, as in all times of crisis, the talking heads are warning of a possible second Great Depression.

There’s no question that we were totally caught off guard and unprepared for this pandemic and the economy fell apart in less than 2 weeks!

Millions of people are unemployed and G7 governments have reacted with economic and bailout packages that are much larger than during the Financial Crisis of 2008-2009.

I’m Betting We All Get Through This

The situation appears pretty dire but life will go on and eventually this crisis will pass. Maybe they develop a vaccine or find an effective drug to fight COVID-19. Maybe the lockdowns and social distancing and the trillions of gallons of hand sanitizer used will bring this pandemic down to a more manageable level. At which point life slowly begins to return to normal. Maybe it’s a combination of all of the above that beats this thing.

One thing is for sure: this crisis will end sooner or later. And when it does, the stock markets will come roaring back.

So whatever you do, don’t panic and sell. The damage is already done so suck it up and keep holding on. Markets always recover in time.

I’m Sticking With My Financial Plan

The last time the markets crashed was during the Great Recession. I had just started investing the previous year at the top of the market. October of 2008 was pretty rough on the markets so I bought a big position in some Canadian banks with borrowed money! By January I was down 30%.

Still, I held on and kept reinvesting the dividends which bought more shares at bargain basement prices. In fact I poured even more money into the markets at that time and a year later I was glad that I held on and kept buying.

I know over the coming months that lots of people will be in ‘survival mode’, but if you can manage it, stay invested and buy more if you can. These are the best prices that you’ll see for another 10 years at least.

I think we all should be budgeting, penny-pinching and building up some kind of emergency fund. We are back to rock bottom interest rates but some of the online banks are still offering decent interest rates. Check out my Tangerine and EQ Bank Reviews for more details on their products and services.

My Approach? Buy, Buy, Buy!

These are lean times so I’m cutting out all non-essential spending for now. I’m re-building my cash cushion and I’ll be aggressively buying up as many shares as I possibly can of my blue chip dividend stocks and index funds. That approach served me well during the last financial crash and I expect the same results for this one.

I’ve already deployed my cash reserves and continue to buy whatever I can with whatever money I get. I’m still reinvesting my dividends and I’m still doing the automatic buys.

It’s important to remember that nobody can call a bottom to the markets until long after the crisis has passed. Remember this was a crash that no one saw coming and all the usual metrics and technical chart reading ain’t worth a dime.

So ignore the talking heads. Be brave, buy, suck it up and buy more if it goes down. 5 years from now we’ll all be glad that we didn’t panic and sell, but held onto our investments and continued to buy more at rock bottom prices.

This week I bought shares in Enbridge (ENB), Suncor (SU), and CIBC (CM). CN rail (CNR) is on my radar but I think it’s still too expensive given the supply shock. The Telecom and Utility sector has come off its highs but still not nearly as cheap as the banks and oil sector.

There may be a lot more pain ahead. I’m for sure anticipating dividend cuts in the energy sector but will be completely shocked and surprised if a bank cuts (those guys made it through Confederation, WW1, the Great Depression, WW2 etc., etc.).

At this point I don’t really see that I have much to lose. If I’m right and this thing eventually goes away and the markets recover I’ll make out like a bandit. If the worse-case scenario happens then we’re all screwed and it won’t matter what moves I make.

Maybe I’ll get into farming… Cheers and Stay Sane out there!

In case you’re wondering here’s where I park my money and some financial services that I use (please note these are affiliate links where this blog may receive a small commission for sales).

For my Daily banking and no-fee cash back credit card I use Tangerine. Curious? Check out my Tangerine vs Simplii Financial review and the Tangerine Money Back Credit Card Review.

For my Savings I use the EQ Bank Savings Plus Account. Never heard of it? Click the link to check out my EQ Bank Savings Plus Account Review.

For investing I use a combination of TD Waterhouse (for legacy investments) and Questrade (low cost stock purchases and free ETF purchases). If you haven’t done so already, check out my Questrade Review to see why it’s the best deal around. Get $50 in Free Trades when you signup for Questrade through this link.