Here’s my updated 2020 Questrade Review and a step by step guide on How To Open A Questrade Account. If you open one through my affiliate link you’ll get $50 in free trades! Below is a review of Questrade, what they offer and why you should open a trading account with them. Following the review, you’ll be guided through the step by step process of opening a Questrade account.

Here’s my updated 2020 Questrade Review and a step by step guide on How To Open A Questrade Account. If you open one through my affiliate link you’ll get $50 in free trades! Below is a review of Questrade, what they offer and why you should open a trading account with them. Following the review, you’ll be guided through the step by step process of opening a Questrade account.

Note: this post contains affiliate links. As an affiliate, this blog receives a commission for each sign up.

Related: Use My Link to Sign Up For Questrade and Get $50 in Free Trades

Questrade Review

Why Open A Questrade Brokerage Account?

If you want to build long term wealth, then you need to start investing your money. It’s not enough to just save money in a savings account that earns a measly 1% interest. You need to be able to invest in high growth assets like stocks, low cost mutual funds or exchange traded funds (ETFs). Opening a discount brokerage account through Questrade is one way to gain access to these investments.

Questrade is the Low-Cost Way to Invest

The single most important take away from this Questrade review is that Questrade is the low-cost way to invest in stocks and ETFs. If you walk into your local bank branch, you won’t get access to these kinds of investments. Instead, the bank will try to sell you their own investment products that come with all kinds of hidden fees.

I’ve never met a rich person who invested in bank mutual funds, and for good reason. As I’ve shown in a prior post on the Danger of Mutual Fund Fees, those fees can eat up to 1/3 of your investment money over a 25 year time horizon.

Mutual Funds Steal From Your Financial Future

Smart investors know that keeping investment costs as low as possible is just as important as earning high returns. A quick example might help here. Let’s say you manage to grow your retirement nest egg to $100k. Here’s the annual cost that you’ll pay under 3 different scenarios:

- When you invest in low-cost ETFs or index funds at a management expense ratio (MER) of 0.30%. Your annual costs will be $300.

- If you invest in a mutual fund from an online bank like Tangerine with an MER of 1.07%. Your annual costs will be $1070.

- You invest in bank mutual funds with an MER of 2.5%. Your annual costs will be $2500.

The key thing to remember when it comes to these fees is that, as your investments grow, so do the fees! That’s why it’s so important to make sure that you own the right investments at the lowest possible costs. This is where Questrade offers investors incredible value.

Questrade Offers $4.95 Commissions on Stock Purchases

If you’re with a discount broker at the bank you can pay anywhere from $9.99 to $29.00 in commissions for stock trades. With Questrade, you pay a minimum of $4.95 when you buy and sell stocks. That’s half price compared to the bank! On top of that, if you sign up through my link, you’ll get $50 in free trades!

Questrade Lets You Buy ETFs For Free!

The thing I’m most excited about with Questrade is that you can buy ETFs for FREE and only pay commission when you sell them. I’m a long term investor that buys and holds index funds for a very long time so this allows me to save some money up front (where it matters most for compound growth).

Think about it, you could set up a monthly purchase plan for some low cost Vanguard funds and your annual investing costs would be miniscule! For those of you who are unfamiliar with Vanguard funds, they offer some of the lowest cost ETFs in the industry!

Open A Questrade Account to Keep Investing Costs Down

So let’s recap a bit here. To build wealth, you must invest in growth assets like stocks and low cost funds. To increase your chances of long term investing success you need to keep investing costs as low as possible. That’s the number one reason why people choose to open a Questrade account – to keep investing costs down!

Besides being the low cost option, here are some other reasons to choose Questrade:

- They offer great customer service.

- They offer an updated trading platform.

- They offer online tutorials and webinars on how to invest (which is great for beginners!).

- And much more. Read their list here.

One Thing To Keep In Mind

Questrade does charge an Inactivity Fee of $24.95 per quarter. To avoid this, make at least 1 stock purchase or sale each quarter, or even setup an automatic purchase of ETFs. If you are 25 years old or younger or you have over $5k in your account, the inactivity fee is waived!

What Kind of Accounts Can I Open With Questrade?

Questrade offers many options for investment accounts. You can open an RRSP, TFSA, RESP or just a non-registered trading account (often referred to as an individual Margin account). If you already have these accounts at another financial institution, you can move them to Questrade and they will pay the transfer fee (just be sure to transfer your investments “in kind”).

Not Just For Canadians…

While Questrade is growing in popularity among Canadians, Americans and citizens of other countries can also open an account.

How Much Money Do I Need to Open A Questrade Account?

If you’re not transferring investments held at another financial institution, you need an initial deposit of $1,000 to open a Questrade Account.

So How Do I Open A Questrade Account?

Opening a Questrade Account is easy. Seriously, the whole process takes less than 20 minutes to complete and within a few days, you should be all set up and on your way investing!

Now that we’re done with the Questrade review, here is the Complete Step by Step Guide to Opening A Questrade Account:

How To Open A Questrade Account

Step 1 Go to the Questrade website and click on the Green “Open An Account” button at the top.

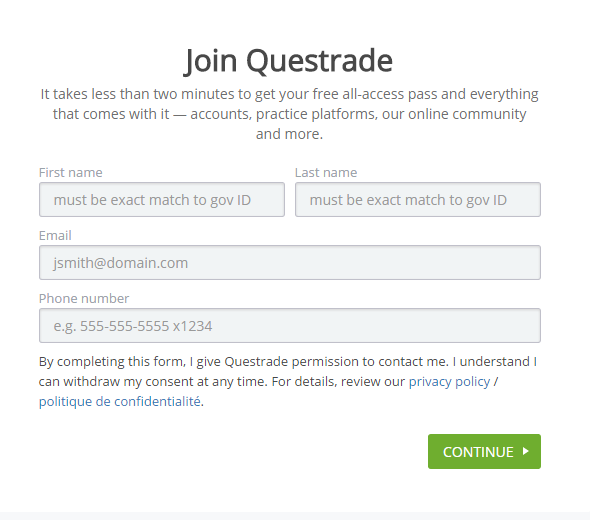

Next, fill out the “Join Questrade” form with your personal info below:

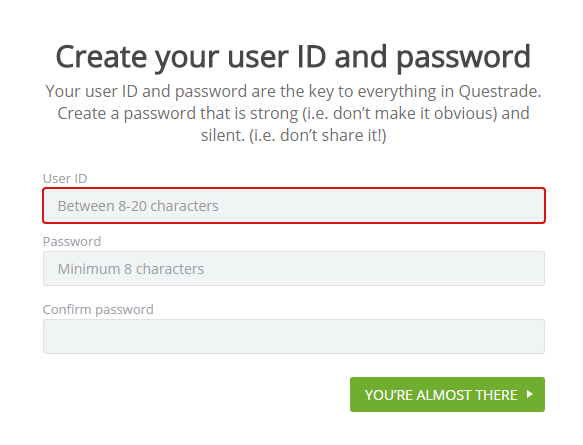

Click “Continue.” On the next screen, create your user ID and password.

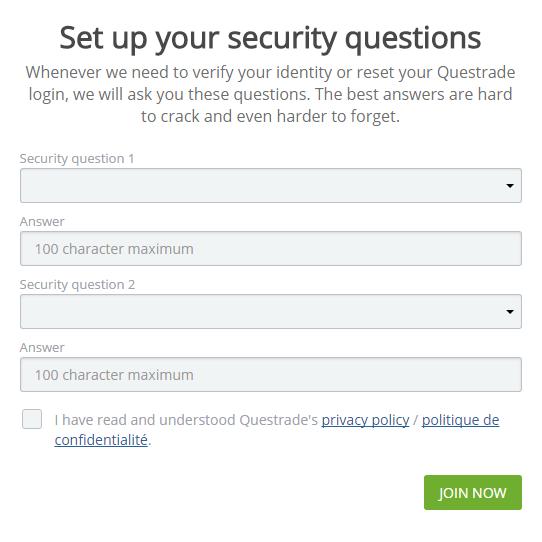

Once you’re done here, click “You’re Almost There” and you will be directed to another page that prompts you to fill out your security questions.

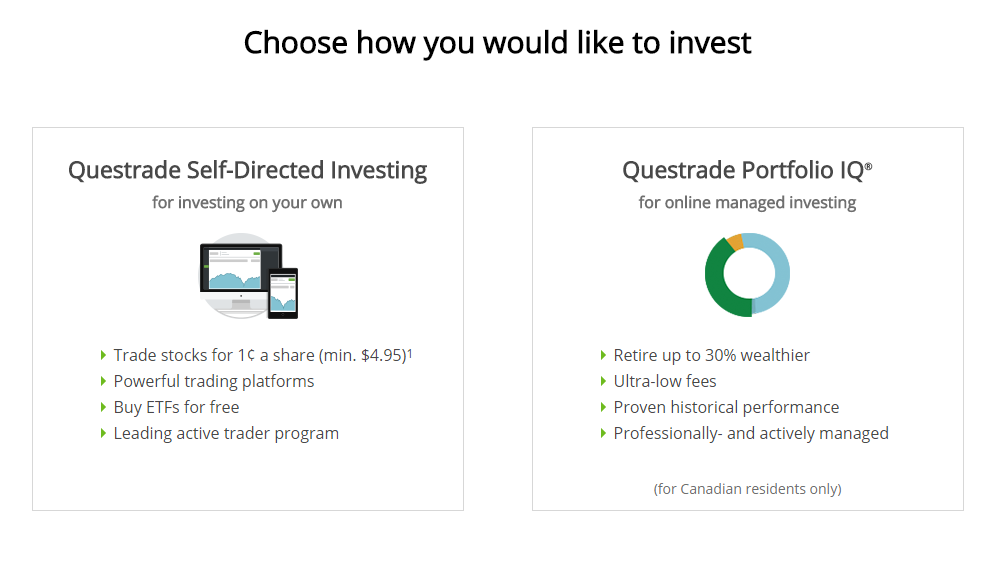

When done, check the box for the privacy policy and click on “Join Now.” The next screen gives you 2 options: self-directed investing or portfolio IQ. Select “self-directed investing.”

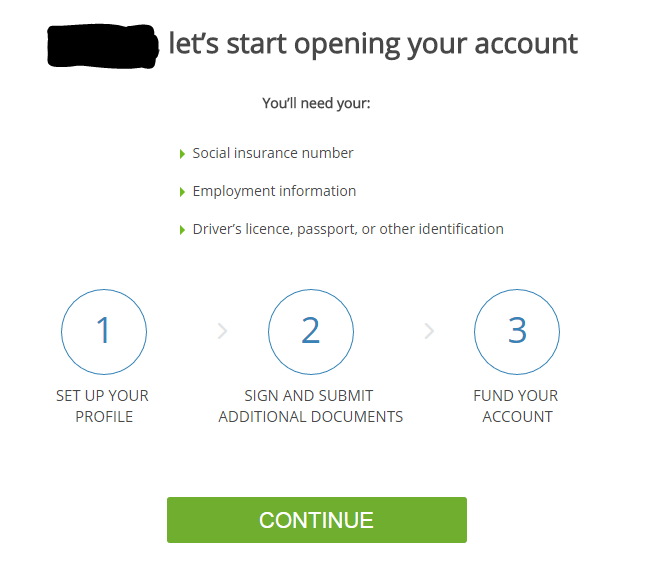

Next, it’s time to set up the account. You’ll need a Social Insurance Number, a government ID and some employer info. When you’re ready, click “Continue.”

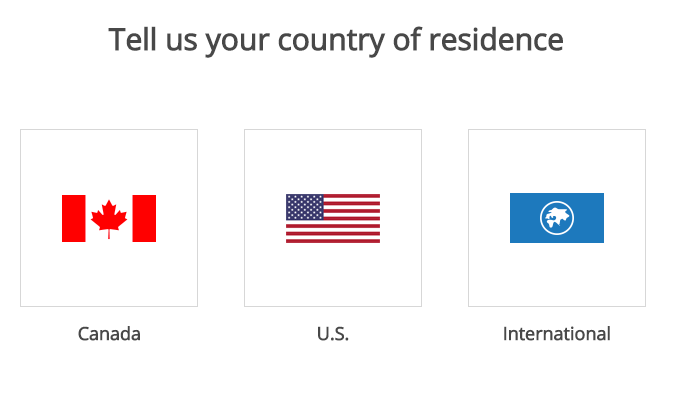

Next, select your country:

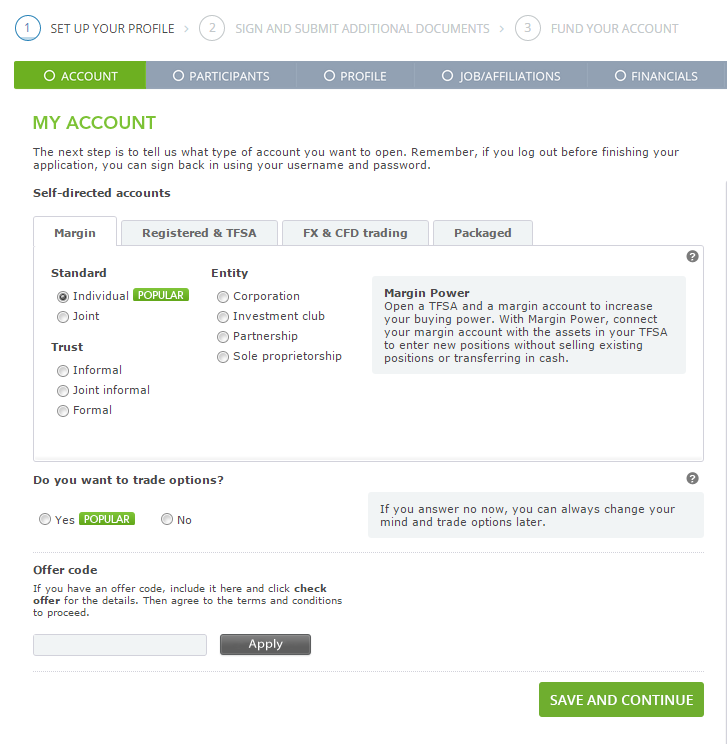

After this, select the type of account you wish to open (ie. Individual, RSP, RESP or TFSA etc):

If you want to trade options select yes, if not, select no. If you’re a beginner I would suggest NOT trading options until you get a little experience with stocks and ETFs. Down the road, you can always change this.

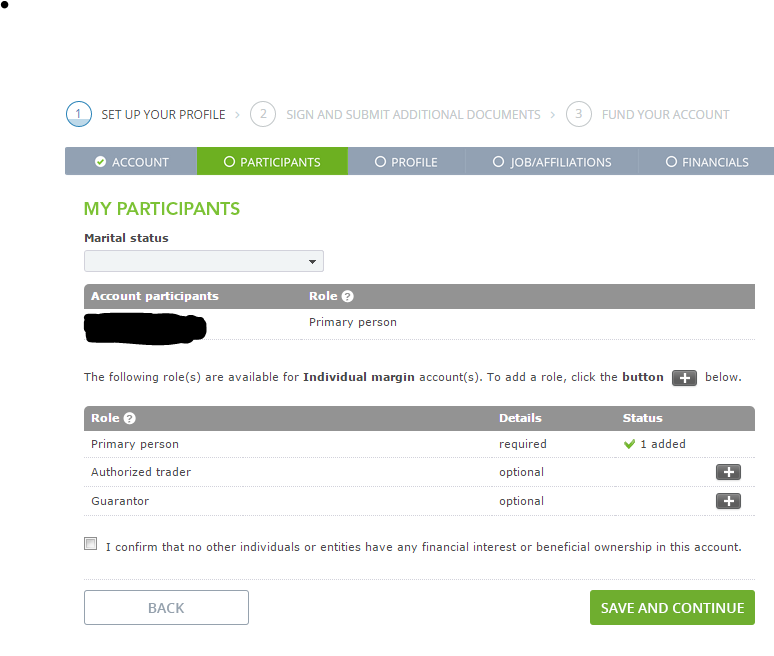

For the next step, you need to fill out your marital status and who will have access and trading privileges for the account:

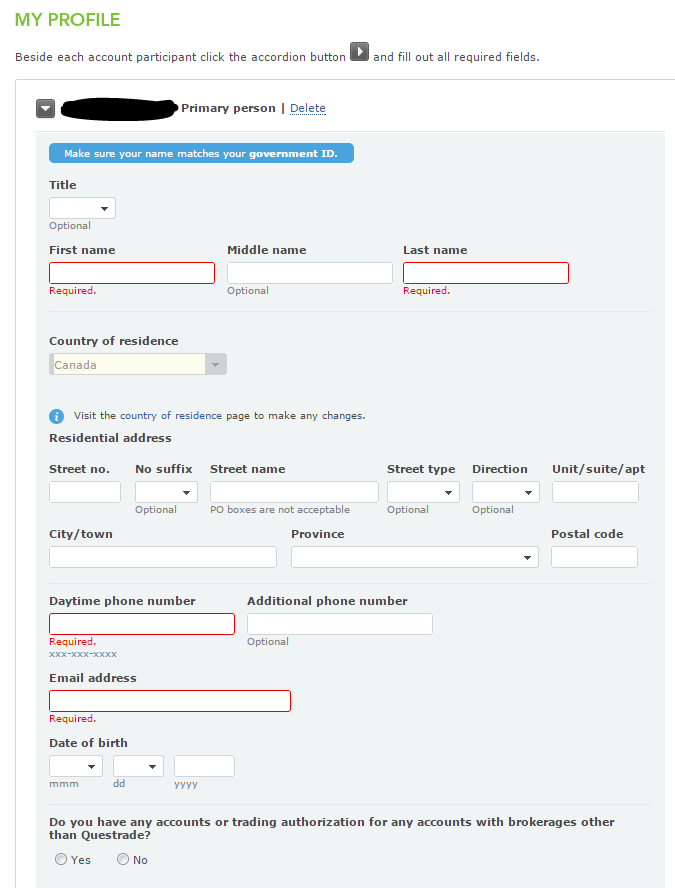

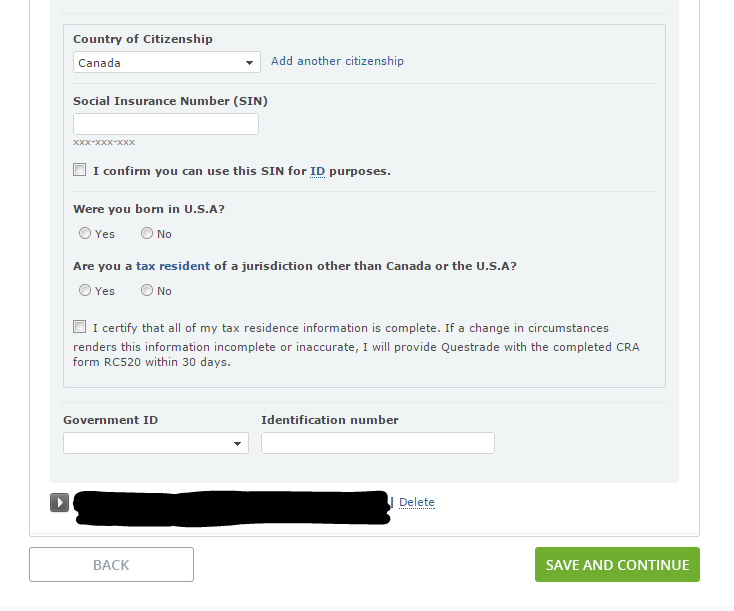

Next, fill out the “My Profile” section below:

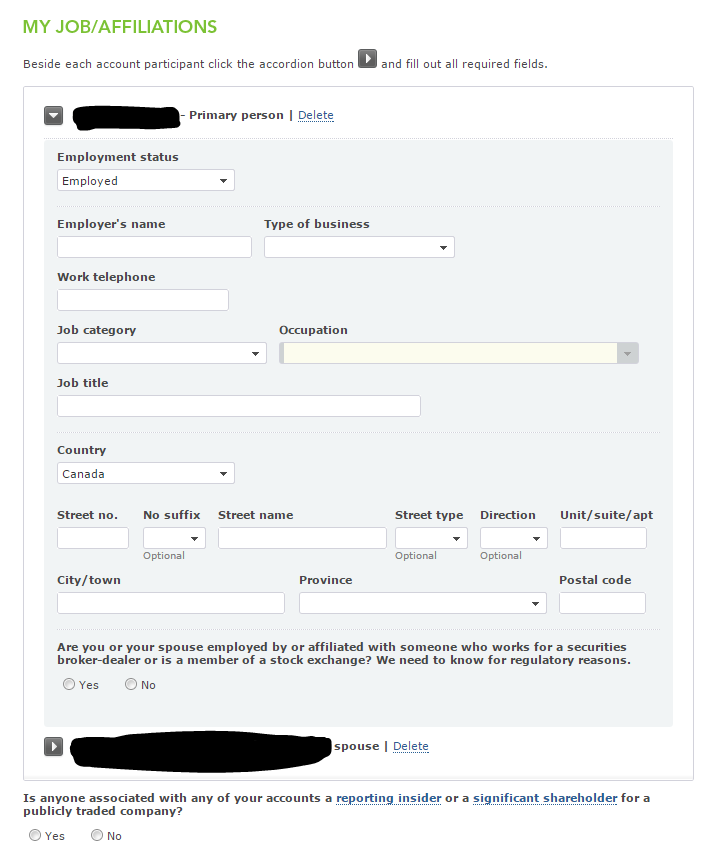

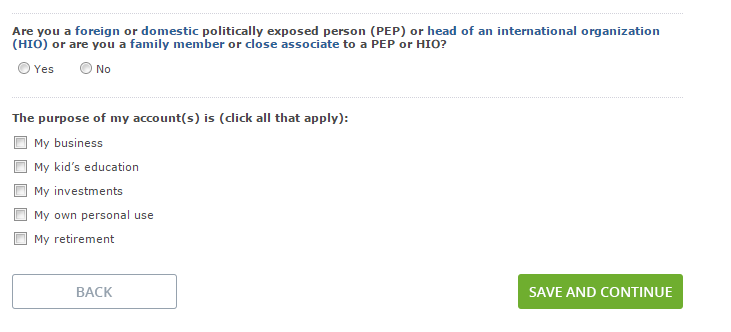

You’ll have to Click “Save and Continue” to get to the next screen. Not to worry, your almost finished! Fill out your job info below:

Click “Save and Continue” to get to the next screen.

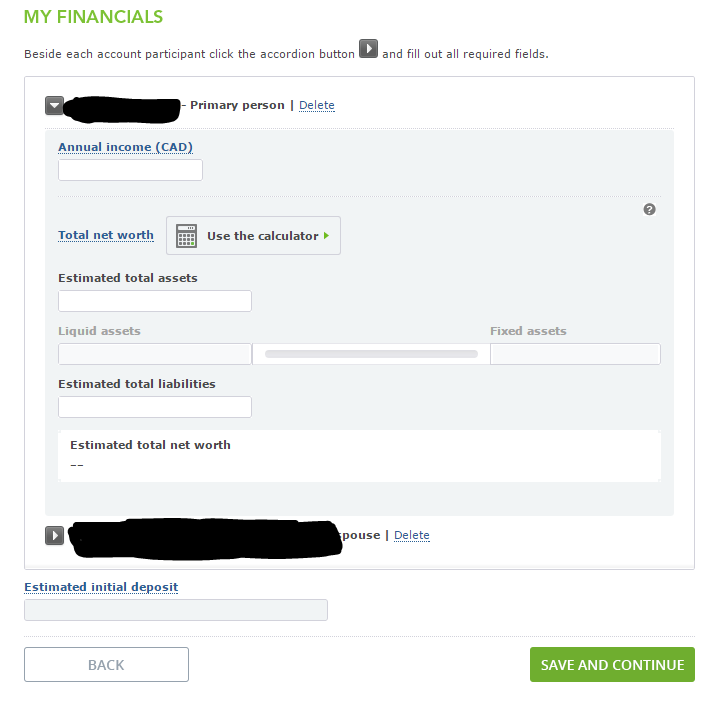

Fill out your financial information and hit “Save and Continue.”

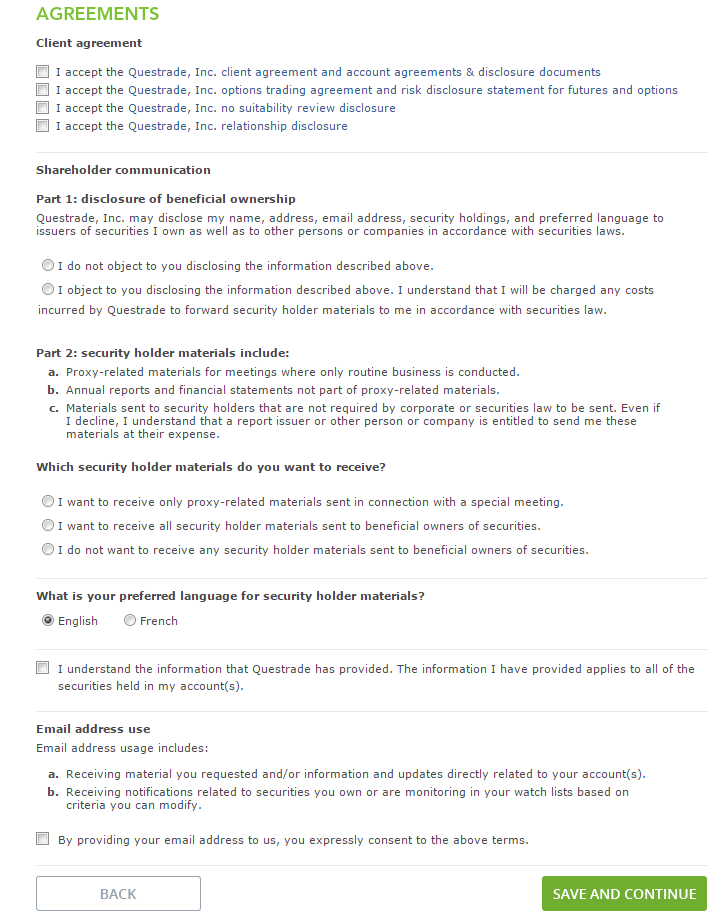

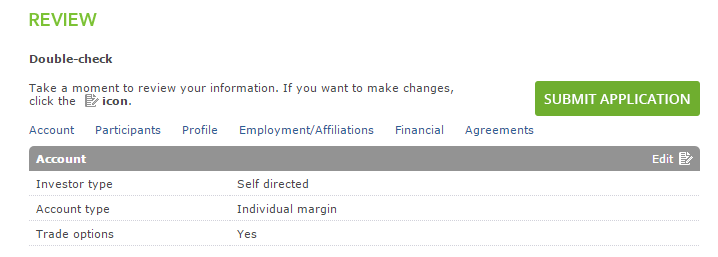

Click on all 4 links in the Client Agreement and scroll down and hit the accept button. For part 1 Disclosure I clicked “I don’t object to sharing my info.” For Part 2 I clicked on “I don’t want any info sent to me.” Fill out the rest and click “Save and Continue.” This brings you to the “Review and Submit” page:

Finally, Click “Submit Application” and Congratulations! You just opened your Questrade Account.

After this, simply review and send any forms they may require and fund your account. You’ll be buying stocks and ETFs in no time and watching that passive investment income grow!

If you’re curious to see what I’m buying and how I’m building my dividend income, check out my monthly investment income updates.

Thanks for reading this Questrade review and guide on How To Open A Questrade Account. Please share this guide on Social Media and with anyone interested in investing for their future.

Happy Investing!

Thanks for sharing. Sounds like a good platform. Especially the no-fee ETF purchases. The glaring downside for me personally would be the inactivity fee. I’m not that active with my investments, so this’ll encourage more trading, which can get a bit ugly (speaking from past experience).

Great comment Tim, I would agree that the $24.95 inactivity fee is an issue. But you can get around that if you’re buying ETFs and top quality dividend stocks and holding them long term. Also, once the account balance reaches $5k that fee is waived. So I really feel like my Questrade account offers great value.