Welcome to my Simply Wall St Review. In today’s post I’d like to introduce readers to a new financial analysis tool called Simply Wall St. For stock market investors, there’s no question that we need some form of baseline knowledge about a particular company before we make an investment. Acquiring, reading and analyzing financial information can seem like a daunting task for the average retail investor.

We simply don’t have the time, money and expertise to create sophisticated algorithms that can analyze the complicated financial information found in company earning’s reports. So it’s always been a challenge for the average investor is to acquire and analyze that kind of information in order to make a sound investment decision. This is precisely where the Simply Wall St tool adds the most value. First, let’s start with a company overview.

What is Simply Wall St?

Simply Wall St is a FinTech startup from Australia that’s developed a new platform for analyzing and presenting financial information about stocks. They cover over 17,000 individual stocks from markets in the US, Canada, UK, Australia and New Zealand. Data for these stocks is updated every 6 hours.

The Simply Wall St platform performs fundamental analysis from data acquired from S&P Capital IQ for the purpose of assisting long term investors with their investment decisions. The great advantage that the Simply Wall St platform has over the competition is in the presentation of that information in a unique infographic called a “Snowflake.”

What is a Snowflake?

As you can see from the above image, a Snowflake is an infographic that displays a company’s financial position. The information presented in the Snowflake is based on an analytical model that uses 30 different data points. That information is then presented in relation to 5 main categories on the Snowflake infographic:

1. Value

2. Future Growth

3. Past Performance

4. Financial Health, and

5. Dividend

This innovative approach allows the user to visually process complex financial information simply by the shape of the “blob.”

Each of the 5 categories has its own section where the information is presented in user friendly graphs and charts. There is also easy to understand analytical explanations of the data being presented.

The infographic above show’s how the Bank of Nova Scotia’s (BNS) stock is presented. As you can see, Scotiabank scores high on past performance, financial health and having a strong dividend, but not as strong when it comes to the value and future growth metrics. I should mention here that all of the big 5 Canadian banks have similar “shapes.”

Portfolio Insights

Not only can you analyze individual stocks with the Simply Wall ST platform, but users can create and analyze their own portfolios. I entered the data from my dividend stock portfolio that’s held in TFSAs and unregistered accounts. Here’s what the “Snowflake” for the portfolio looks like:

This is pretty much what I would have expected since the portfolio is constructed of solid blue chip dividend payers. What’s notable is that the portfolio doesn’t offer a lot of growth. If I wanted a portfolio with more emphasis on growth, there is an option that lets the user explore other stocks that fall into that category.

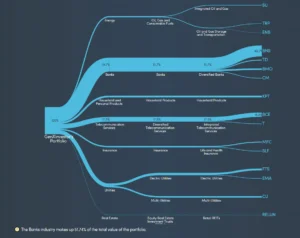

Simply Wall St offers a variety of other useful infographics. For example, there ‘s one that shows the portfolio’s diversification. I was especially interested in this since I spent much of 2016 trying to diversify away from some of my core financial holdings. Here’s what my portfolio diversification looks like:

Investment Ideas

Like many investors, I have my stock screeners to help me identify and explore investment ideas. The Simply Wall St platform also has a section on investment ideas where users can search out stock investment opportunities that fall into categories of growth, value or high yielding dividends for example. Users can also do “grid” searches where they click and drag the shape of the Snowflake and form it into something that they’re looking for.

Blended Portfolios of Stocks and Mutual Funds or ETFs

There’s no question that Simply Wall St has a lot to offer stock investors, however, it does not have high quality mutual fund or ETF data. So for those with blended portfolios of stocks and funds the quality of the analysis won’t be all that useful. This is one area where this some room for improvement and I’m sure the company is already thinking about expanding the platform to cover funds as well. I think that including funds as well as stocks would add a lot of value to this platform.

What Plans does it offer?

Simply Wall St offers a free 14-day trial for those interested in exploring the platform. The company offers an individual paid plan account for about USD $130 per year. There is also a free Learner plan that allows a limited number of company report viewings (10 each month), and the ability to input 1 portfolio.

Overall Impression

Overall I think Simply Wall St is a useful research tool for stock investors. It’s user friendly, visually appealing and the complex financial information is presented in an easy to understand way. I was particularly impressed with the portfolio analysis feature. I encourage each and every one of you to sign up for the free 14-day trial to check out the platform. Thanks for reading my Simply Wall St review.

Disclosure: Please note this article contains affiliate links. If you sign up for a paid account I will receive a small commission.